vat regisration service sharjah

vat regisration online sharjah

vat return filing service in sharjah

vat registration consultant in sharjah

vat implementation service in sharjah

vat consultancy services sharjah

vat de-regisration service sharjah

We offer reliable VAT registration services in sharjah. You can register for VAT online by following our instructions. we give best service for vat de-regisration, vat consultancy, vat implementation, vat return filing, vat regisration online, vat regisration service.

vat de-regisration service sharjah vat consultancy services sharjah vat implementation service in sharjah vat return filing service in sharjah vat regisration online sharjah vat regisration service sharjahVAT Registration in Sharjah

On January 1st, Abu Dhabi, United Arab Emirates, imposed a Value Added Tax (VAT). The Federal Tax Authority (FTA) imposed a 5% VAT on all goods and services in Abu Dhabi, United Arab Emirates. Because VAT is an indirect tax, it is ultimately the responsibility of the end user. The company collects VAT on behalf of the government at each point of sale.

VAT registration requirements in the UAE. The UAE Federal Government imposed VAT on January 1, 2018, and it is now in effect across the country’s seven emirates, including Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, and Fujairah. Companies that meet the following criteria are required to register for VAT.

(A) Companies must register for

Documents Required for Sharjah VAT Registration

1. The trade licence of a firm house.

2. A certificate of incorporation or registration, if required.

3. Any other document that offers information about the organisation to management, such as the memorandum of association, articles of incorporation, partnership agreement, or bylaws.

4. A copy of the manager’s Emirates identification card and passport

5. Information on the signatories.

6. The physical location of the company’s headquarters.

7. Contact details for the company.

8. Details on the company’s bank account.

9. A list of prior partners and other commercial ties in the UAE, as well as copies of their trade permits.

10.Declaration from the applicant’s business house regarding: a) Details of the applicant’s business activity; and b) Estimation of financial transaction values.d) Information about the applicant’s past 12 months’ revenue

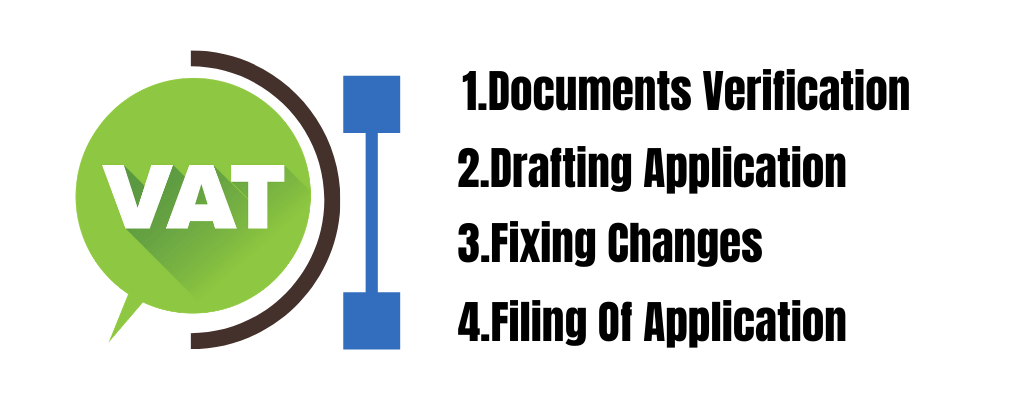

Process For Vat Registration In Sharjah

Supplies Not Qualified for Input Charge Recuperation underneath VAT in UAE

Underneath VAT in UAE, enrolled businesses are qualified to recoup...

Read MoreHow to Choose Time of Supply for Organizations

For supply of organizations, the way of choosing the time...

Read More